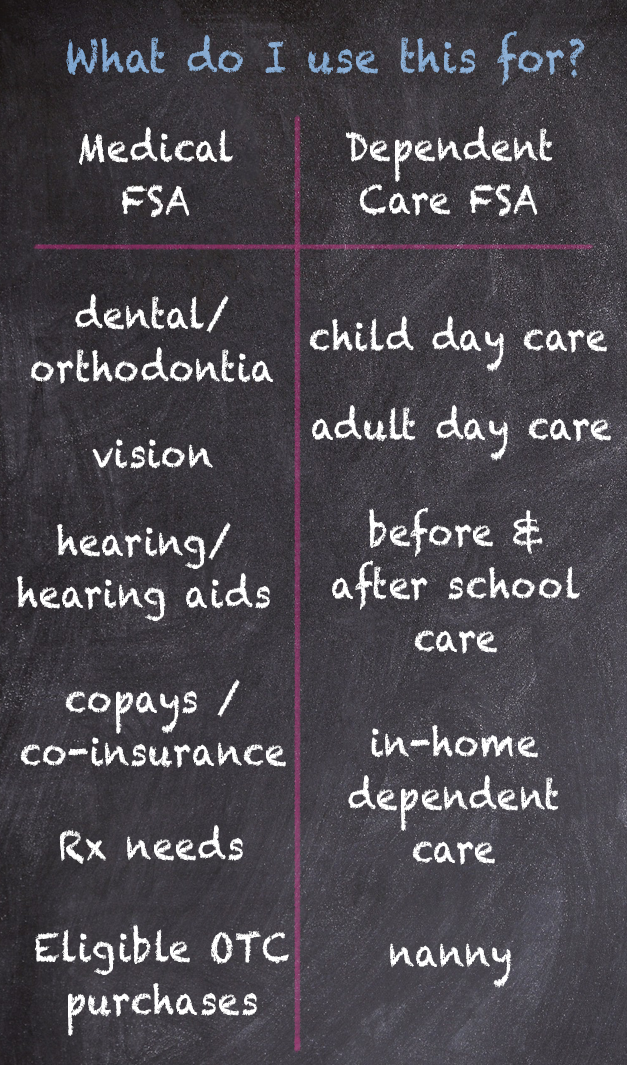

2025 Fsa Limits Daycare. Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). This is an increase of $150 from 2025.

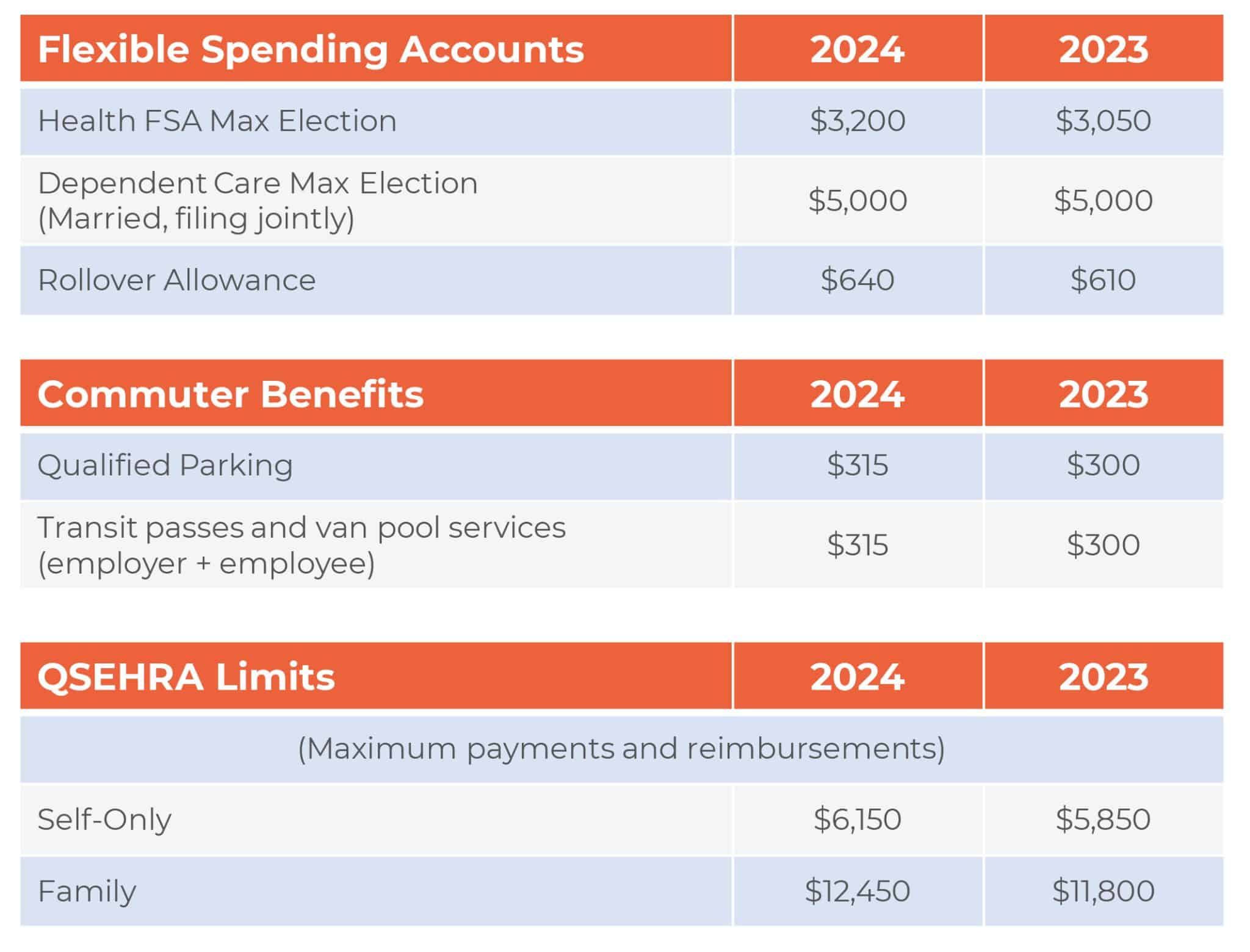

[2025 fsa updates] health care fsa plans saw a $150 increase in annual limits. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex hcfsa).

You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

2025 fsa hsa limits tommi isabelle, the limit on annual contributions to an ira increased to $7,000 in 2025, up.

Fsa Limits 2025 Dependent Care Tera Abagail, The dependent care fsa limit remains fixed (with no inflation adjustment) at $5,000. Join our short webinar to discover what kind of expenses are covered and strategies to maximize your annual savings.

2025 Fsa Hsa Limits Tommi Isabelle, Each year, the irs outlines contribution limits for dependent care accounts. Eligibility requirements are different in each state.

Dependent Care Fsa Limit 2025 Covid Ericka Deeanne, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The dependent care fsa (dcfsa) maximum annual.

What Is The Max Fsa Contribution For 2025 Wendy Joycelin, The dependent care fsa limit remains fixed (with no inflation adjustment) at $5,000. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

What Is The 2025 Fsa Limit Lynne Konstance, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex hcfsa). This is an increase of $150 from 2025.

Max Daycare Fsa 2025 Daisy Therese, The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after january 1, 2025. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

Irs Dependent Care Fsa 2025 Jayme Loralie, Between august 1 and october 7,. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. Each year, the irs outlines contribution limits for dependent care accounts.

Just In 2025 Benefit Limits HRPro, You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. Here, a primer on how fsas work and why they are an essential way to.

2025 Vs 2025 Hsa Contribution Limits Lynne Rosalie, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after january 1, 2025.

The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after january 1, 2025.